The Nigerian Prince scam: Everything you need to know

The Nigerian Prince scam is one of the oldest online fraud schemes intended to steal people’s money and personal information or drag unwitting victims into illegal activity. Going forward, we’ll look into how the Nigerian Prince scheme works, talk about its infamous history, and discuss what measures you should take to avoid falling victim.

Contents

What is a Nigerian prince scam?

The Nigerian Prince scam is a phishing attack when swindlers reach out to potential victims and promise a large sum of money in return for some help. Victims are usually asked to make an advance payment or share their personal details to get their reward. The Nigerian Prince scam is also known as advance fee fraud or 419 fraud, referring to the Nigerian Criminal Code section dealing with swindling.

Though there are many variations to the Nigerian Prince scam, it usually employs these elements:

- A wealthy individual. Traditionally, fraudsters pretend to be a person of nobility, a high government official, or a person in business who has gone into trouble and temporarily lost access to their wealth.

- Appealing backstory. The Nigerian Prince scam relies heavily on opportunism and appeals to people’s kindness, greed, or sense of responsibility. Scammers tell of their children taken hostage, spiteful relatives trying to seize their wealth, or political unrest making them fugitives or guiltless prisoners. The key element of every story is the vast riches belonging to the person that approached you, which can also become yours.

- Call to action. After pleading their case, swindlers ask for help, promising a significant reward once they regain their wealth. Scammers usually ask for wire transfers to pay their bailout of prison, to bribe corrupted guards, or to release their children from kidnappers. In other cases, swindlers might ask for your personal information, such as identification or social security numbers and bank account details, promising to transfer their fortune to your bank account for safekeeping.

- Disappearance. After the victim reveals their sensitive information or transfers the money, fraudsters simply disappear.

Though the most common way to approach potential victim is by email, it’s not unusual for the scammers to reach out through snail mail or social media.

The evolution of the Nigerian prince scam

The Nigerian Prince scam has been up and running since the early days of the internet, but its origins precede the digital age. The most famous predecessor of the 419 fraud is a swindling scheme called The Spanish Prisoner, which kicked off in the 19th century. A con artist, allegedly a war prisoner in Spain, would send a letter to a potential victim asking for help to retrieve the prisoner’s vast riches hidden in their home country. In return, the prisoner offers a share of their wealth if the victim agrees to send some money upfront for bail or bribes to the prison guards.

Following historical events, Spanish prisoners evolved into French or Russian prisoners, and swindlers became more inventive with their stories. One popular scam included a request for financial aid to pay for the cleaning supplies so that the robbers could clean the bills they stole from bank and stained with ink in an attempt not to be caught.

At the end of the 20th century, when the internet was still in its early stages, Nigeria became one of the biggest hubs for online fraud. People started to receive emails from allegedly wronged and robbed Nigerian nobility, who told tragic tales and asked for financial aid, promising great wealth in return. This fraudulent scheme circulated so widely that it soon became a cliché, giving a new name to the not-so-new advance fee scam.

The Nigerian Prince scam can quickly adapt to the changing times and mirror real-world events. Scammers can now present themselves as Ukrainian business people in the refuge or U.S. soldiers on a mission, asking for your help and ready to unfreeze their savings for you.

Examples of the 419 scam

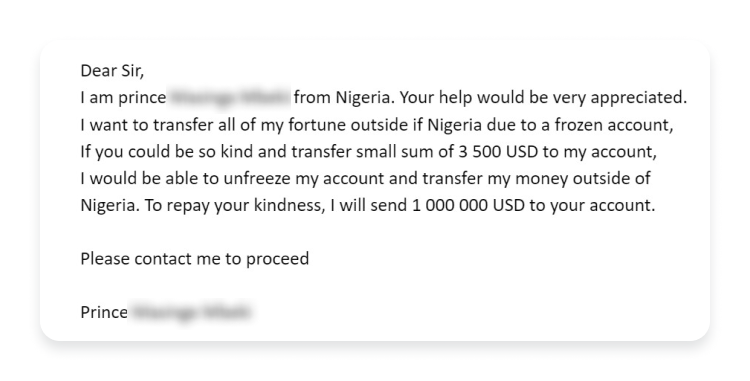

The rich history of the Nigerian Prince scams shows that swindlers can find many ways and use diverse stories to approach their prey. Some choose to be laconic and count on the naivety of addressees, like in the below example:

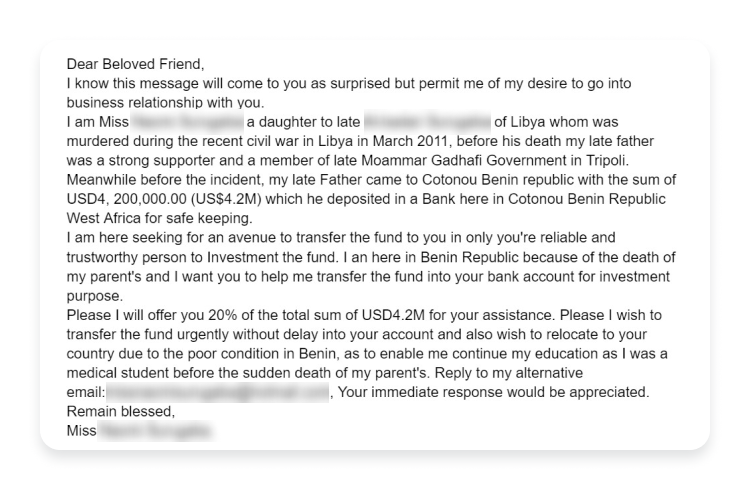

Other scammers tend to use a more traditional model of 419 scams, counting on tragic tales and appealing to victim’s goodwill.

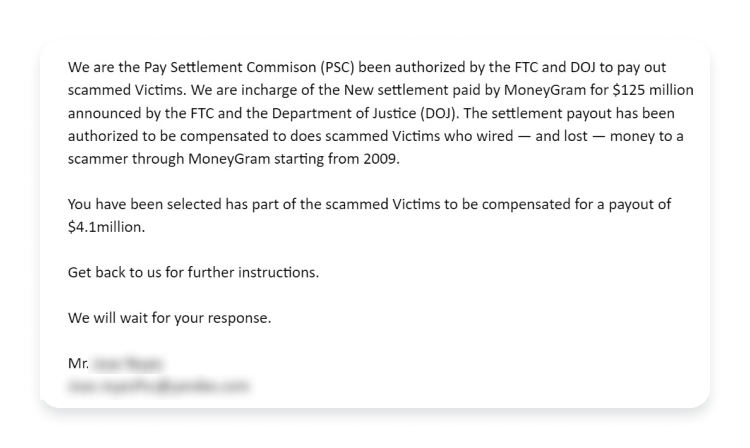

Some scammers are bold enough to appeal to previously scammed victims, offering them compensation.

Though 419 fraud has many faces, they all have some standard features that can be easily recognized. Here are the predominant ones:

- Sender’s email address is very long and comes from an unusual domain.

- You are addressed in generic terms (Dear Sir/Madam) or by your email address rather than your name.

- Email text contains a lot of mistakes.

- An email comes from a country you don’t have any ties to.

- The sender promises an unrealistic amount of money.

- You are asked to send money in advance or to reveal your personal data.

Is the Nigerian Prince scam still popular?

The Nigerian Prince scam remains popular thanks to its ability to adapt to changing times and the inexhaustible creativity of scammers using new social engineering schemes. Traditionally, the 419 fraud relied on the volume: the more email scams sent, the more victims were caught. However, email scams are growing to be more personalized, thanks to an abundance of leaked or stolen personal information that can be found online.

In recent years, many swindlers have aimed at businesses and their employees. One of the most prevalent examples is a CEO scam, when frauds pretend to be company CEOs and ask employees to pay invoices. Another version that targets businesses is a vendor email scam: a scammer creates an invoice that looks identical to the one that a real vendor would issue and sends it to the unaware employees possibly using the vendor’s services. Scammers also found a way to trick people seeking jobs: swindlers, pretending to be recruiters, ask for a small advance payment to cover the cost of training, uniforms, and other fees for their assistance.

Fake websites and domain names are a new twist that upped frauds’ game, making scams look more convincing and legitimate. This improvement especially works in cons focused on individuals. With the seemingly legitimate page of a fake business or its owner, more people can be lured into phony investment opportunities or give away their bank account number to be used for illicit money laundering operations.

Some victims might also be tricked into money-drenching romance shams. Once a swindler acquires the victim’s trust, they ask for money or gifts or claim they need money for a personal emergency, promising to repay a more significant sum afterward.

How do scammers get my contact information?

The easiest way for swindlers to get your contact information is through online databases. Even being extra cautious about which websites to trust with your contact information, you can find yourself a victim of a massive data breach that exposed your password, email, and other personal information. Having limited pieces of your private data fraudsters may use it to reach out to you and try to get more detailed information, later on using it in elaborate fraud schemes.

To avoid being pwned, it is essential to keep yourself from oversharing your personal details (such as email or phone number) on social media and only register accounts with trustworthy websites.

What to do if you received the 419 scam?

If you received a mysterious email offering an unrealistically big amount of money for just a little bit of financial assistance — do nothing. It’s likely a 419 scammer trying to trick you into one of their schemes. Even being astute in cybersecurity and using the internet consciously might not be enough to save yourself from being spammed by the Nigerian Prince and other scams. It’s normal to be targeted at the accounts you use most often.

The best way to act is to ignore unsolicited, phishy-looking emails, flag them as spam, and not to click on any links or documents to download — they will most likely spread viruses and malicious software to your device.

How to protect yourself against email scams

Though it’s close to impossible to make your inbox spam free, there are some measures you can take to prevent yourself from receiving and possibly falling victim to online scams.

- Be skeptical. Don’t trust unknown individuals online and offers that sound too good to be true. Because they probably are.

- Don’t share your personal details online. You can make yourself vulnerable to email phishing attacks by sharing your email or phone number, or other personal details such as your birthday, address, or profession, online. The more information a swindler has, the more personalized scam they can serve you. Also, never provide any financial information if you weren’t the one that initiated the contact with the person that approached you.

- Have several email accounts. Diversifying your email accounts can significantly reduce spam in your professional inbox. Moreover, every email account providing different bits and pieces of your personal information makes you a harder-to-trace target for swindlers.

- Don’t reply to spammy emails. Though it might be tempting to contact the swindler that approached you and see what they’re playing at, your answer will reveal that your email account is active — the scammer will have one more piece of valuable information about you.

- Be careful with new invitations on social media. Not every business owner on LinkedIn who offers a once-in-a-lifetime investment opportunity has a business in the first place. Be cautious of new acquaintances online, and don’t reveal any sensitive information about yourself.

Want to read more like this?

Get the latest news and tips from NordVPN.